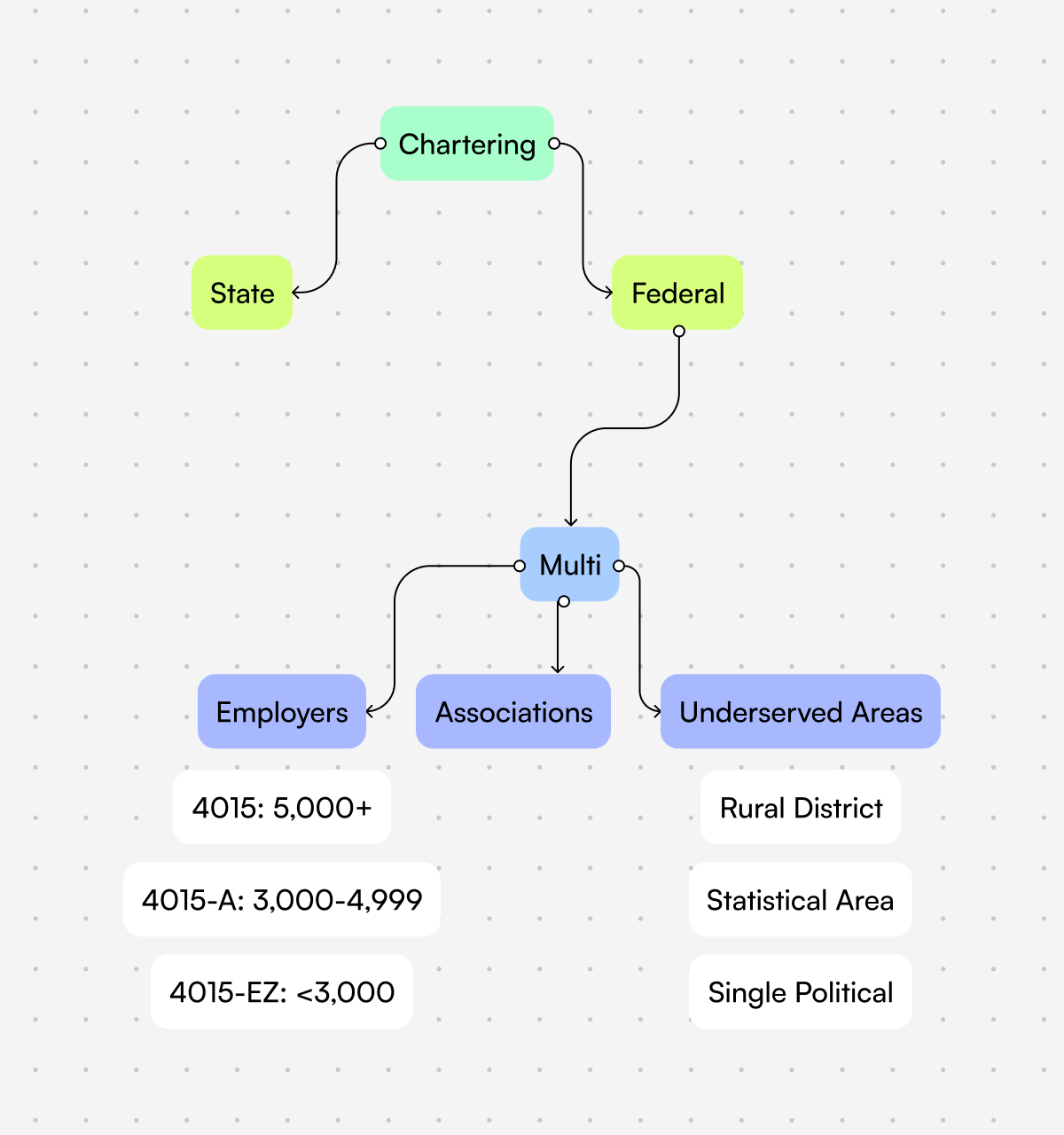

Strategic Field of Membership and Chartering Solutions

Achieve Your Largest Expansion Opportunity

Field of Membership is your gateway to sustainable, strategic growth. Whether you're looking to convert your charter, expand into underserved areas, add associations or more, we help you achieve your goals with smarter, faster paths to expansion. Learn more about our entire suite of market expansion solutions.

Maximize Market Potential with Our Proven Strategy, Technology and Expertise

We help you identify and execute field of membership (FOM) and chartering changes that support your growth objectives. With deep expertise navigating complex state and federal regulations, we work with both federal and state-chartered credit unions across a range of initiatives.

Federal Charter

Expansions

Federal credit unions that are looking to reach more potential members need a partner with fluency in the NCUA Field of Membership Manual. We develop a deep understanding of your credit union’s differentiators and vision for the future to identify compliant FOM options that best align with the strengths and goals of your credit union.

Track record: We've successfully guided credit unions across the country to obtain approval for strategic Federal FOM changes.

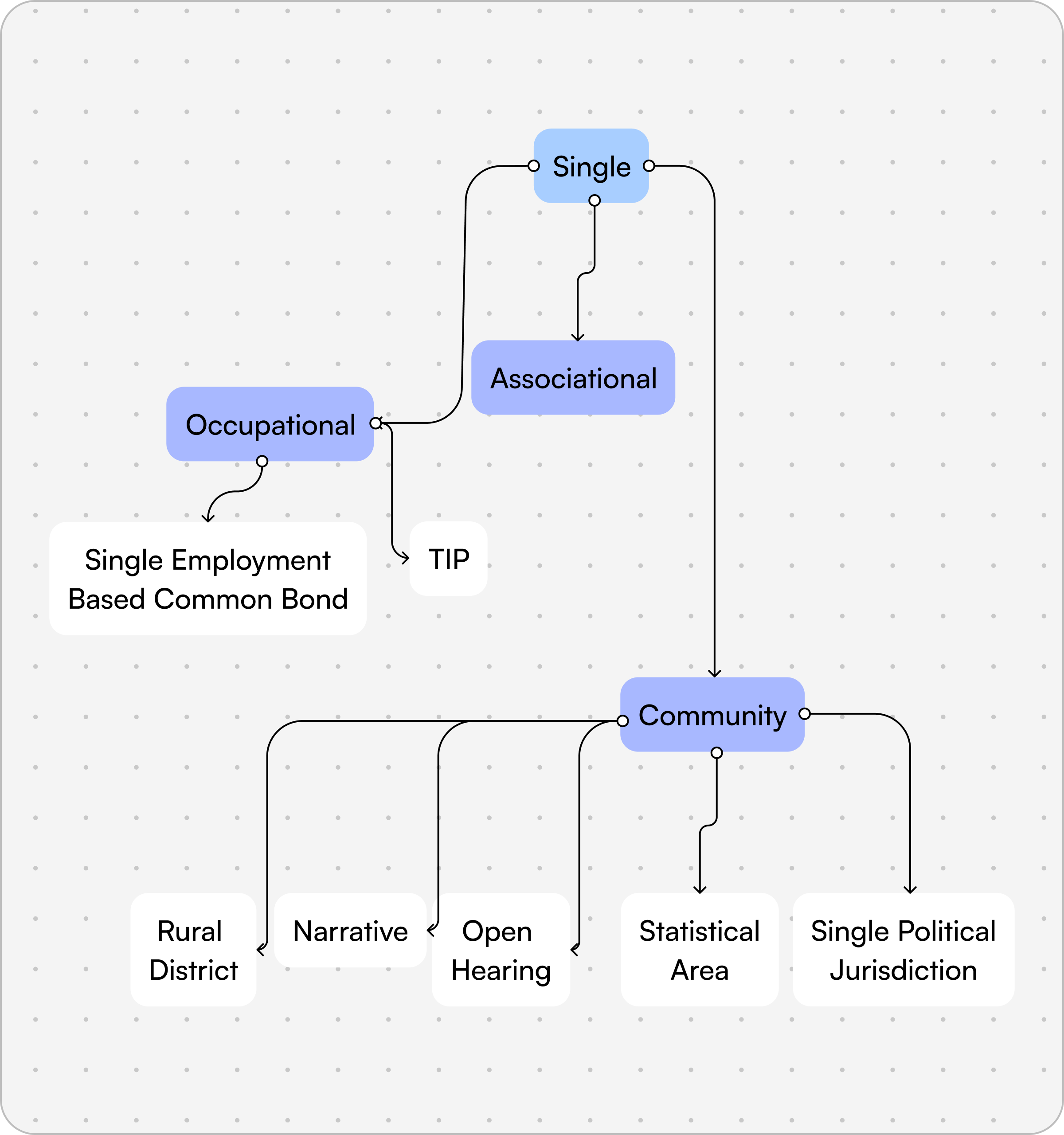

Single Common

Bond Charters

The Field of Membership options for Single Common Bond Charters include occupational, associational, or Trade Industry & Profession (TIP). Credit Unions exploring this charter type should consider the depth and strength of their relationship with a single sponsor, their penetration of the sponsoring organization, and the size of the credit union’s potential membership pool against strategic goals.

Credit unions with a single SEG partner and highly tailored products and services might find that a Trade, Industry & Profession charter allows them to expand their field of membership while continuing to serve a niche market need.

We help Single Common Bond credit unions, and credit unions considering the Single Common Bond charter type understand potential differentiators, assess opportunities, identify compliant FOM language, consider implementation of any changes, and navigate regulatory approval.

Track record: We've helped small and midsize credit unions transition into new charters that better reflect their member bases and open growth opportunities.

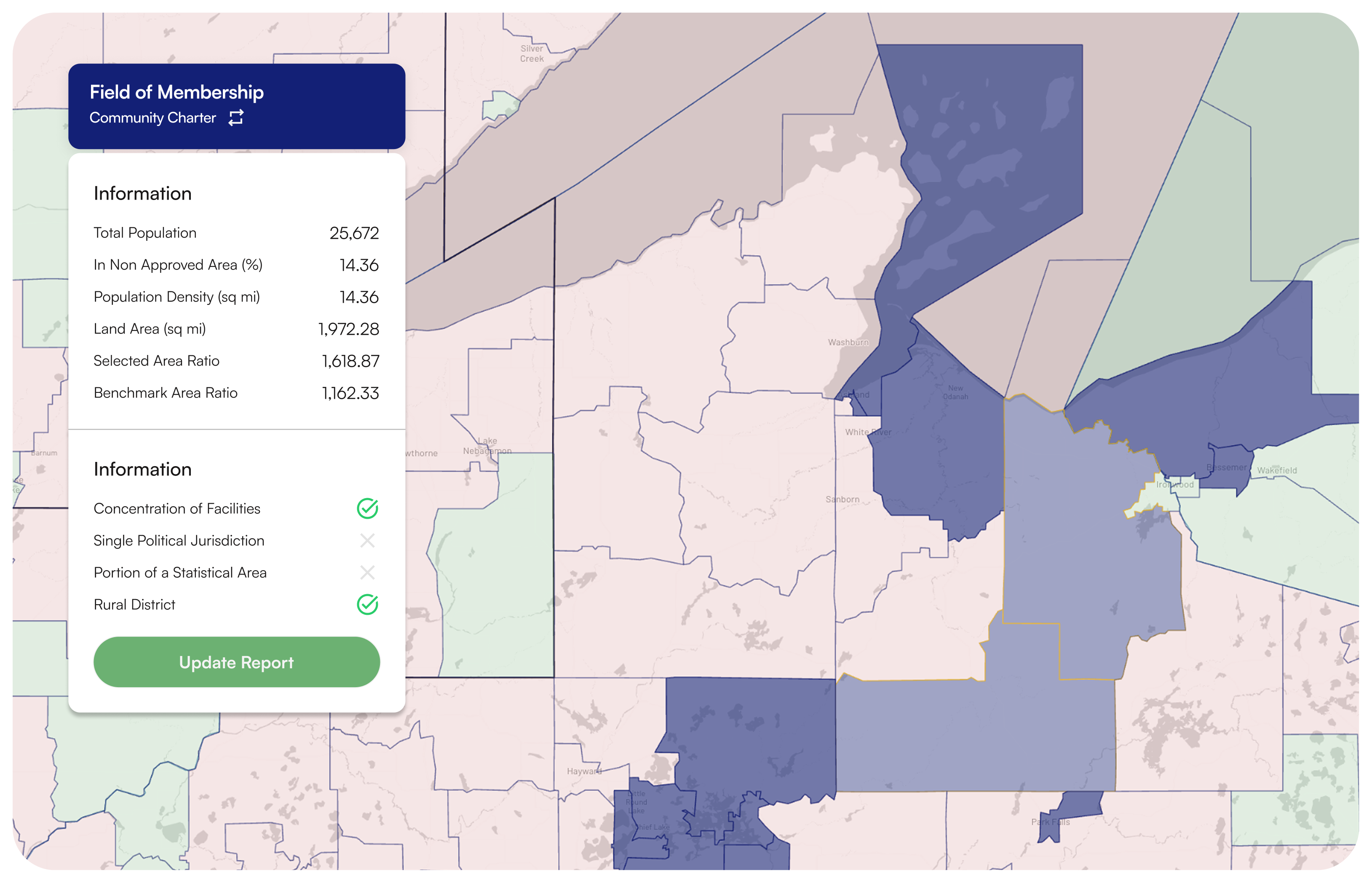

Community Charter Expansions

CUCollaborate helps community-chartered credit unions (and credit unions exploring a community charter) design and win approval for Field of Membership (FOM) expansions based on where people live, work, or worship. Because the NCUA sets specific geographic and documentation requirements, we combine regulatory expertise with data-driven mapping to identify communities that are both compliant and aligned with your growth strategy.

What we offer:

For Narrative Communities: Narrative research and drafting

For Public Hearings: Speaker prep and scripting

Community Types We Support

01

Single Political Jurisdiction

If a narrative community exceeds 2.5 million in population, an open hearing is the final step. CUCollaborate has successfully supported approval for the only open-hearing narrative community in history—helping with strategy, preparation, and execution.

02

Statistical Area

For metropolitan communities with populations under 2.5 million, our software efficiently computes and visualizes compliant statistical areas. This allows for effective scenario comparison, boundary analysis, and selection of the most suitable option for your market objectives.

03

Rural District

Rural districts can be a powerful path for credit unions outside major metros, with specific population and density requirements. We model multiple scenarios to uncover non-obvious compliant pathways and maximize alignment between your FOM and long-term growth plans that often reveal options credit unions wouldn’t find independently.

04

Narrative Communities

When a community must be supported through a narrative, we bring deep expertise in meeting the NCUA’s rigorous research standards. We start by assessing approvability early to avoid wasted effort, then execute the research and drafting efficiently using proven frameworks and supporting evidence.

05

Public Hearings (Large Narrative Communities)

If a narrative community exceeds 2.5 million in population, an open hearing is the final step. CUCollaborate has successfully supported approval for the only open-hearing narrative community in history—helping with strategy, preparation, and execution.

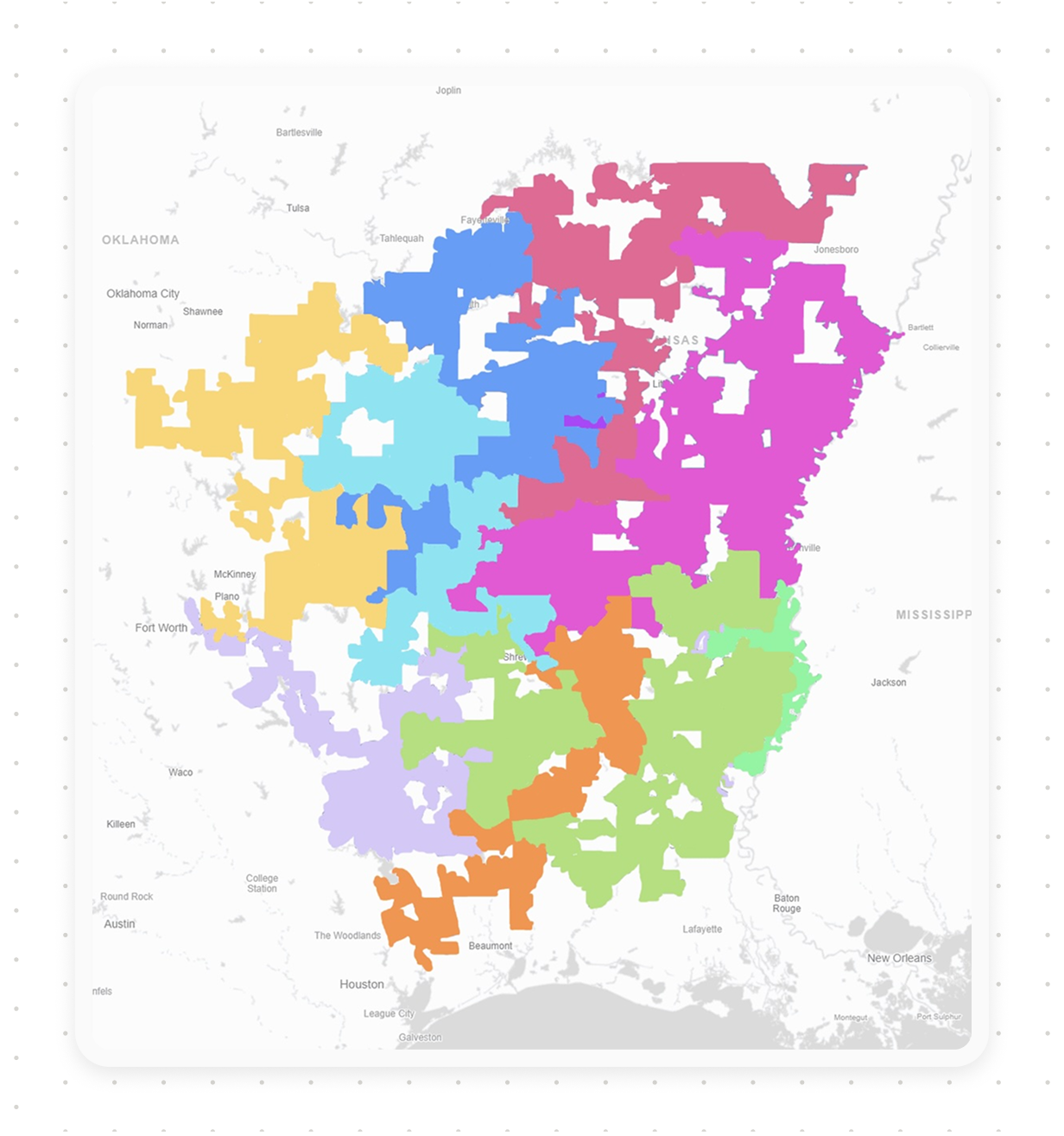

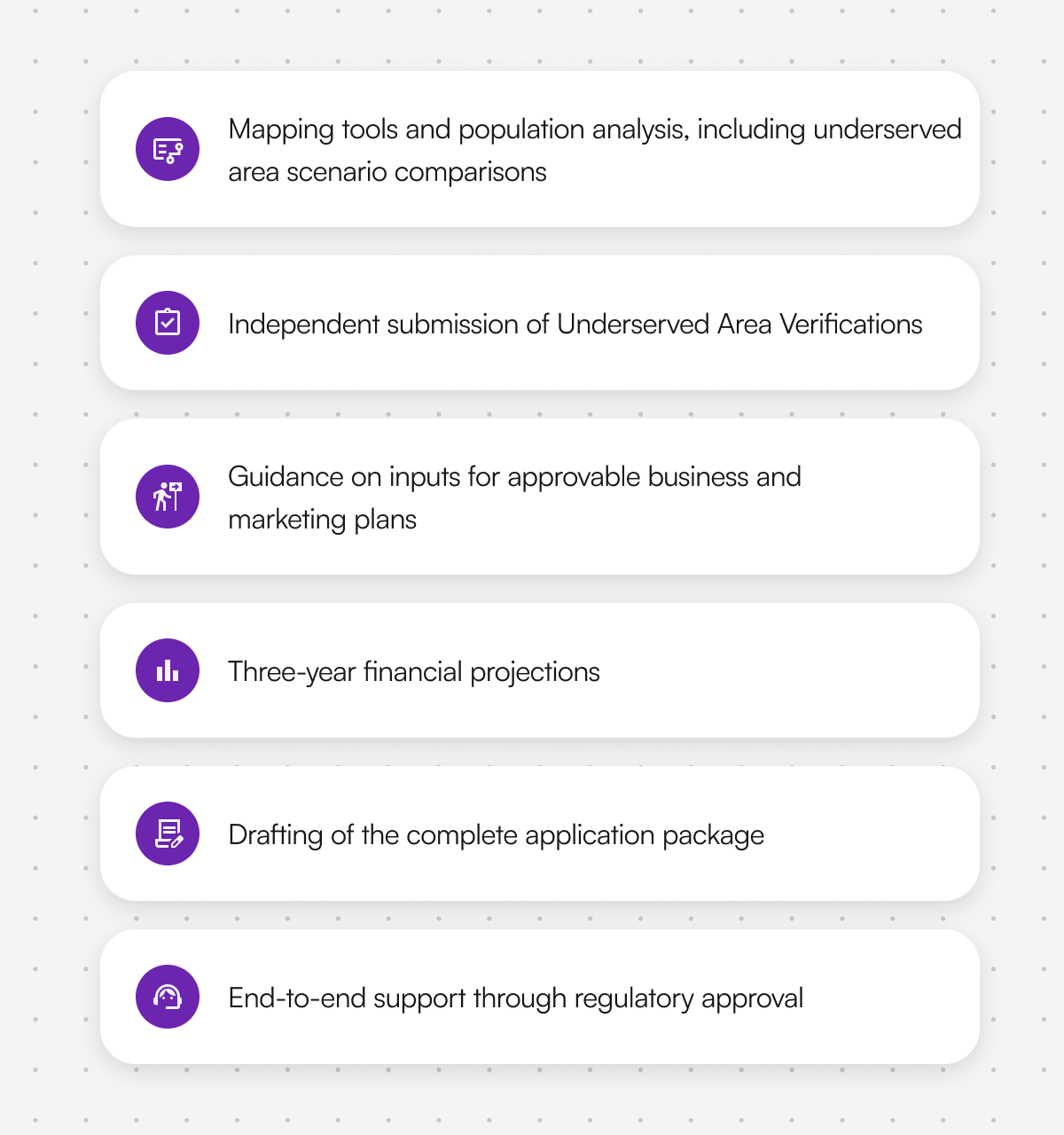

Multiple Common Bond Charter Expansions

CUCollaborate helps credit unions get the most from a Multiple Common Bond (MCB) charter, which offers three pathways to expand eligibility: Select Employer Groups(SEGs), Qualifying Associations, and Underserved Areas. For credit unions that are running into the limits of community charter definitions, we bring the strategy, analytics, and application expertise needed to build a successful Field of Membership (FOM) expansion without guesswork.

How we help across all three MCB pathways

We start with a structured assessment of your current (or planned) MCB Field of Membership to identify the strongest opportunities across the three pathways and determine what will be most compelling and most efficient for regulatory approval.

01

Underserved Areas

Our software includes algorithms purpose-built to draw regulatory compliant underserved areas that capture as much of your priority geography as possible. We help you interpret and apply the NCUA’s underserved-area criteria, run scenario comparisons, and evaluate where the best opportunities exist.Underserved areas can also support broader objectives such as expanding access to traditionally underbanked populations, improving ROI on community partnerships and branding, simplifying eligibility, and strengthening local ties. As underserved areas become larger or more complex, the business and marketing plan expectations increase. We guide you through what the NCUA will expect, gather the right inputs from your team, and translate them into a clear, approvable plan.

02

Associations

We help credit unions evaluate whether an association meets NCUA common bond requirements and whether it is realistically approvable. We also support credit unions in identifying and partnering with open associations that have broad eligibility criteria, enabling service to individuals regardless of where they live or work. When the process is complex, our team manages the details and guides you through to completion.

03

Select Employer Groups (SEGs)

Adding SEGs is another way to expand membership. Because NCUA requirements scale with SEG size and structure, we help you navigate the nuances, assemble supporting information, and position your SEG additions for approval.

State Charter

Expansions

State credit union field of membership regulation varies across the country. We tailor our support to state-specific requirements. Our team bridges regulatory interpretation between state and federal guidance where needed.

What we offer:

Project management from scoping to submission

Coordination with state regulators

Application deliverables aligned to unique state requirements

Support on member communications, notices, and voting

Track record: CUCollaborate has helped credit unions in 26 different states expand their field of membership.

Federal and State Charter Conversions

Federal and State Charter Conversions are a fit for credit unions looking to maximize advantages with a comparison of the regulatory benefits offered by each. Field of Membership constraints, interest rate and lending limits, and borrowing and investment restrictions among other elements should be considered in the decision to convert.

What we offer:

Side-by-side comparison of charter benefits and trade-offs

Coordination with both state and federal regulators

Identification of compliant and strategic FOM

Project management including guidance on collection of inputs

Drafting of conversion requirements

Guidance on submission

Support throughout the review process

Guidance on member vote and materials

Learn more about our entire suite of market expansion solutions.

Our Process

Our custom-built software with precise mapping tools, predictive models and algorithms powers highest potential market opportunity scoping and identifies strategic paths for expansion.

Our advisory team with you and regulators throughout the full application process.

Discuss Your Expansion Goals

Scoping & Strategy

Market and demographic analysis

Project Management

From timelines to submission

Application Development

Business plans, mapping, marketing strategy

NCUA Q&A & Liaison

Regulator relationships and responses

Post-Approval Support

Workflow integration, compliance, and branding

What Customers Are Saying

FOM Expansion Case Studies

Market Expansion

Advisory Team

Our team brings decades of experience in credit union mergers, strategic planning, and financial modeling.

Interested in Expanding Your

Field of Membership?

Schedule a consultation with us to learn about how we can help your Credit Union achieve its growth goals.

Learn more about additional strategies for expansion with our entire suite of market expansion solution

.png)