National Auto Loan Network and CUCollaborate Partner

NALN and CUCollaborate Partner to Help Credit Unions Retain Low-Income Designation and CDFI Certification

.png)

New Partners

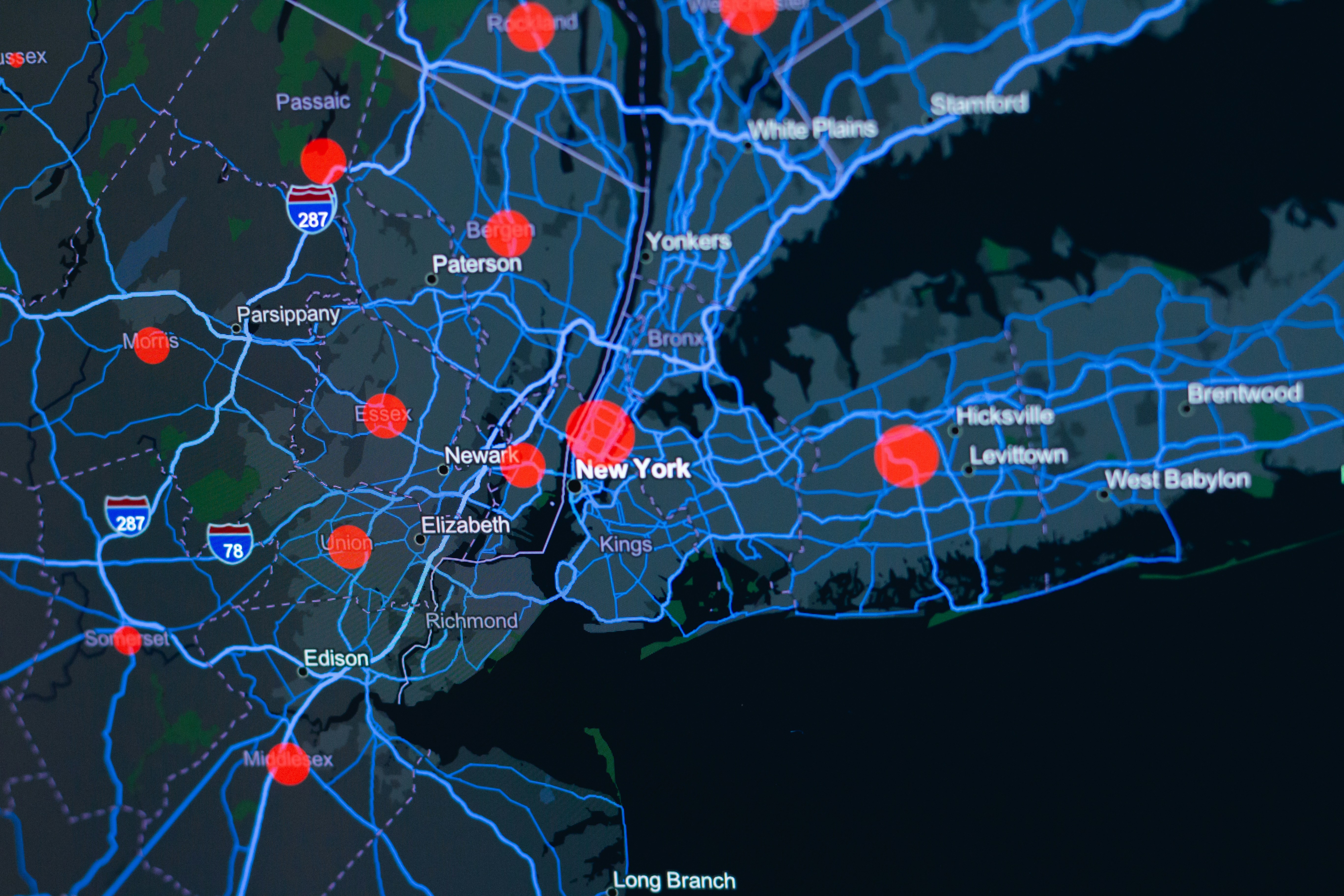

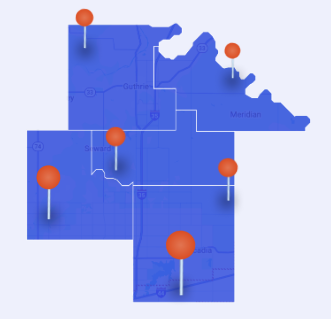

The National Auto Loan Network (NALN) and CUCollaborate have entered a strategic partnership to connect credit unions with more individuals in underserved areas and populations. By leveraging CUCollaborate’s Application Programming Interfaces, NALN can now identify and memberize consumer applicants, assisting credit unions in attaining and retaining their Low-Income Designation and CDFI Certification (CDFI).

“Through this strategic partnership with CUCollaborate, we embark on a mission to empower credit unions in attaining and retaining their low-income designation and CDFI Certification. Together, we aspire to build a collaborative ecosystem that not only supports but also champions the communities they serve, fostering a resilient and inclusive financial land scape for all,” said Marco Rasic, President and CEO of NALN.

“Our newly formed partnership with NALN will provide another tool to support credit unions’ LID and CDFI strategies,” commented Sam Brownell, Founder and CEO of CUCollaborate. “As credit unions continue to navigate connecting their mission to business practices, reaching members through these governmental programs will become ever more critical.”

About NALN

NALN has operated as a direct-to-consumer auto finance company since 2010, specializing in the refinancing of consumer auto loans throughout the United States. The company’s objective is to address the needs of underserved individuals by offering equitable and accessible access to market-rate financing. This is achieved through strategic partnerships with banks, finance companies and credit unions.

Company News

.jpg)

.png)

.png)

.jpg)

.jpg)

.jpg)