Regulatory Shakeup Fails to Slow Charter Growth in Q1 2025

Charter and FOM approvals rose in Q1 2025 despite NCUA uncertainty. See the year-over-year trends driving credit union growth.

.png)

NCUA Field of Membership Expansion Analysis

The first quarter of 2025 was anything but ordinary for the National Credit Union Administration (NCUA). Broader regulatory uncertainty dominated headlines as industry-specific uncertainty over the agency’s independence and structure swirled. It would be understandable to see a potential slowdown in processing of chartering and field of membership. This article examines approvals for various field of membership expansion types to assess year-over-year activity from NCUA between Q1 2024 and Q1 2025.

Despite regulatory disruption, field of membership application approval increased year-over-year through the first quarter of 2025, both in application approval volume and total potential membership increases to credit unions.

Community Charter Applications

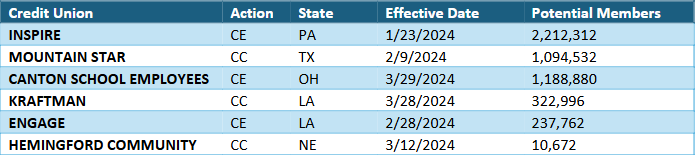

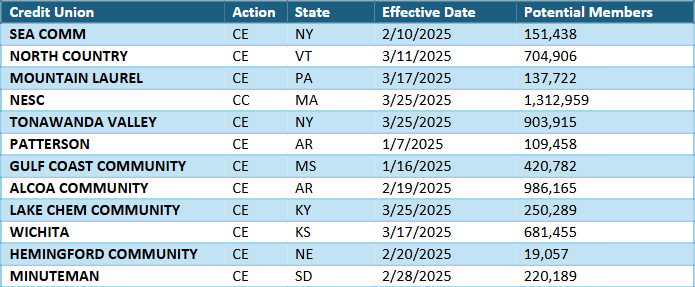

Community Charter approvals, which represent both field of membership expansions to existing community charters and community charter conversions increased by 100% year-over-year in Q1, with Q1 2024 seeing 6 such approvals and Q1 2025 seeing 12 applications:

Q1 2024 Community Charter Approvals

Q1 2025 Community Charter Approvals

While application count approvals were up 100% year-over-year, the total potential membership added via community charter expansion increased only 16% year-over-year. Driving this was the average population size of each charter expansion decreasing. The average community charter expansion application approved in Q1 2024 represented 844,526 potential members. In Q1 2025, the average community charter application’s total potential members decreased to 491,258.

Underserved Area Expansions

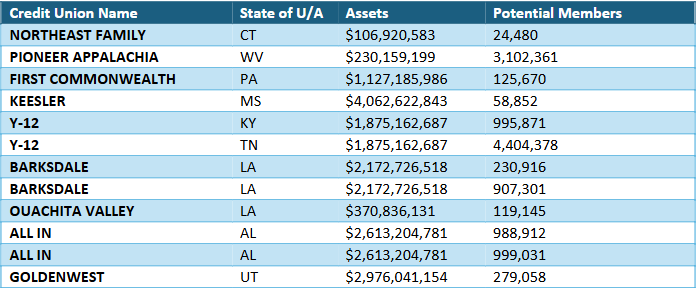

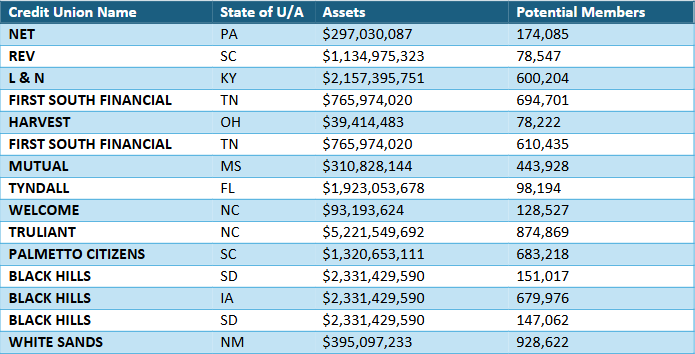

Underserved Area expansions saw a similar trend to those of Community Charter Expansions. Individual package approvals as reported by the NCUA increased 25% from Q1 2024 (12 approved packages) to Q1 2025 (15 approved packages), but the total potential membership population of those approvals decreased 48% (12,235,975 total potential members approved through underserved areas in Q1 2024 compared to 6,371,607 in Q1 2025).

Q1 2024 Underserved Area Expansion Approvals

Q1 2025 Underserved Area Expansion Approvals

Note: Some entries above may represent multiple underserved area expansion packages.

Conclusion

The first quarter of 2025 challenged the NCUA and the credit union industry with regulatory instability and structural ambiguity, yet field of membership application approval increased rather than stalled. Both Community Charter and Underserved Area expansions not only maintained momentum but, in terms of total application volume, exceeded the prior year. This resilience underscores the urgency and determination among credit unions to expand access and relevance—even as the policy environment remains unsettled.

CUCollaborate clients experience review periods ranging from 2-3 months on the low end for smaller, more manageable requests up to 12+ months for some of the largest historical approvals on record.

📅 Schedule time with our market expansion team to discuss your credit union's growth strategy!

Field of Membership Expansion